Welcome!

Let me start by introducing myself, I’m Dick, the sole principal of Hogue & Associates. I have more than 30 years of actuarial, employee benefit and computer systems experience.

J. Richard Hogue, FSA, MAAA

Want to learn more about reporting for postemployment benefits? Start here

About Us

Hogue & Associates provides cost-efficient OPEB actuarial services for postemployment accounting standards. We specialize in actuarial consulting within retiree healthcare and related fields. The services we provide include actuarial valuations and disclosures reports related to GASB 75 and FASB ASC 715-60. We work with public and private sector employers across the United States who need help reporting on their OPEB plans. Our cost-efficient approach was developed to meet the needs of small to medium-sized private businesses and governmental employers.

Services

- Actuarial valuation and disclosures reports related to complying with OPEB accounting and financial reporting requirements

- OPEB plan design consulting

- Plan experience analysis

- Second opinion on any OPEB topic but especially on any technical issue related to GASB 75, such as the following:

- deferred outflows of resources and deferred inflows of resources

- determination of the expected long term rate of return on plan assets on funded plans

- determination of the discount rate

- any topic related to the total and/or net OPEB liability

- the alternative measurement method

- any other topic related to the financial reporting of OPEBs

Contact us to learn more about our actuarial consulting services.

What is GASB 75 and FASB ASC 715: Reporting for postemployment benefits in the public and private sectors

GASB Statement 75 is issued by the Governmental Accounting Standards Board. It became effective for state and local government employers in fiscal years beginning after June 15, 2017. GASB 75 relates to accounting and financial reporting for “Postemployment Benefits Other Than Pensions” (OPEB). It measures long-term obligations and the annual costs of OPEB benefits. It was preceded by GASB 45.

Similar to GASB 75 for the public sector, FASB ASC 715 -60 establishes accounting standards for postretirement benefits other than pensions, most notably postretirement health care benefits. FASB 715-60 applies to all private employers, including not-for-profit entities, that offer OPEB benefits to their employees such as retiree health insurance.

Historically, OPEB benefits were reported on a pay-as-you-go (cash) basis until FAS 106 was issued in 1990. FAS 106 significantly changed how employers reported OPEB benefits on their financial statements by requiring accrual of the expected cost of providing those benefits to an employee and the employee’s beneficiaries and covered dependents.

Issue Brief: Impact of COVID-19 on Pension Plan Actuarial Experience and Assumptions, Including Mortality

Contact Us

THE IMAGES

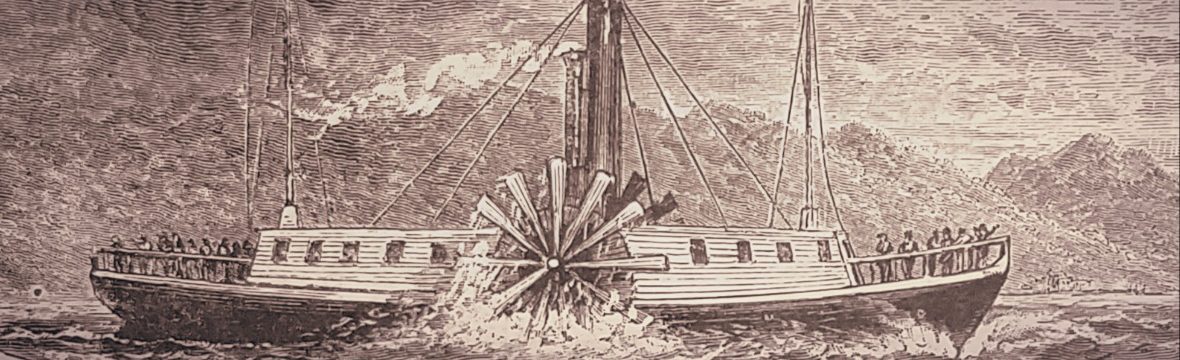

The fact that a firm like Hogue & Associates, with a single office, is able to provide actuarial and consulting services to organizations nationwide is only possible because of advancements made in communication and other technologies over the past few centuries.