id=”h-hogue-and-associates”>Hogue and Associates

At Hogue & Associates, we deliver cost-efficient OPEB actuarial services tailored for private and government sector employers. Our expertise lies in actuarial valuations for post-retirement healthcare and related fields, with a focus on addressing the unique needs of small to medium-sized businesses and government agencies.

Founded in 1989, we have specialized in the post-retirement healthcare (OPEB) space for over three decades. Today, more than 75% of our work involves FASB ASC 715-60 and GASB 75 OPEB actuarial valuations, ensuring compliance with accounting standards and helping our clients effectively manage their liabilities. The remainder of our time is dedicated to actuarial consulting in other healthcare-related areas, bringing a holistic approach to benefit plan management.

Our commitment is to provide personalized, efficient, and accurate actuarial services that empower organizations to balance cost management with meaningful retiree benefits.

J. Richard Hogue, FSA

- Fellow of the Society of Actuaries

- Member of the American Academy of Actuaries

J. Richard Hogue, known as Dick, brings over 30 years of experience in helping employers navigate FASB and GASB accounting standards related to retiree healthcare and life insurance plans. A Fellow of the Society of Actuaries and a Member of the American Academy of Actuaries, Dick has worked extensively with private and government sector employers across the United States, specializing in small to medium-sized organizations.

Dick firmly believes that the best way to choose a professional consultant is by seeking feedback from current and former clients. To support this, he encourages prospective clients to contact his past clients directly and provides a list of references upon request.

With a reputation built on expertise, trust, and personalized service, Dick is committed to helping organizations balance compliance with cost-effective solutions for retiree benefits.

Web mentions & recommendations

THE IMAGES

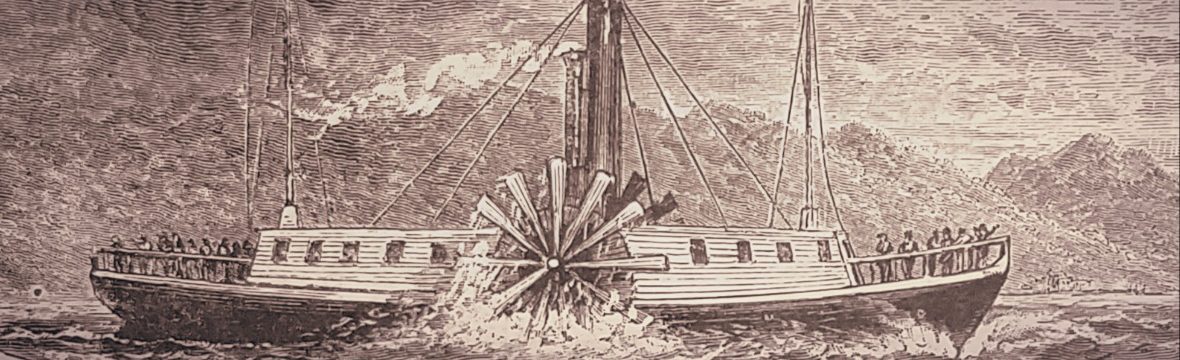

The fact that a firm like Hogue & Associates, with a single office, is able to provide actuarial and consulting services to organizations nationwide is only possible because of advancements made in communication and other technologies over the past few centuries.